Mariano Rajoy. President of the Spanish government

Soraya Sáenz de Santamaría. Vice-president of the Spanish government

Cristóbal Montoro. Minister of Finance of the Spanish government

José Ignacio Wert. Minister of Education, Culture and Sports of the Spanish government.

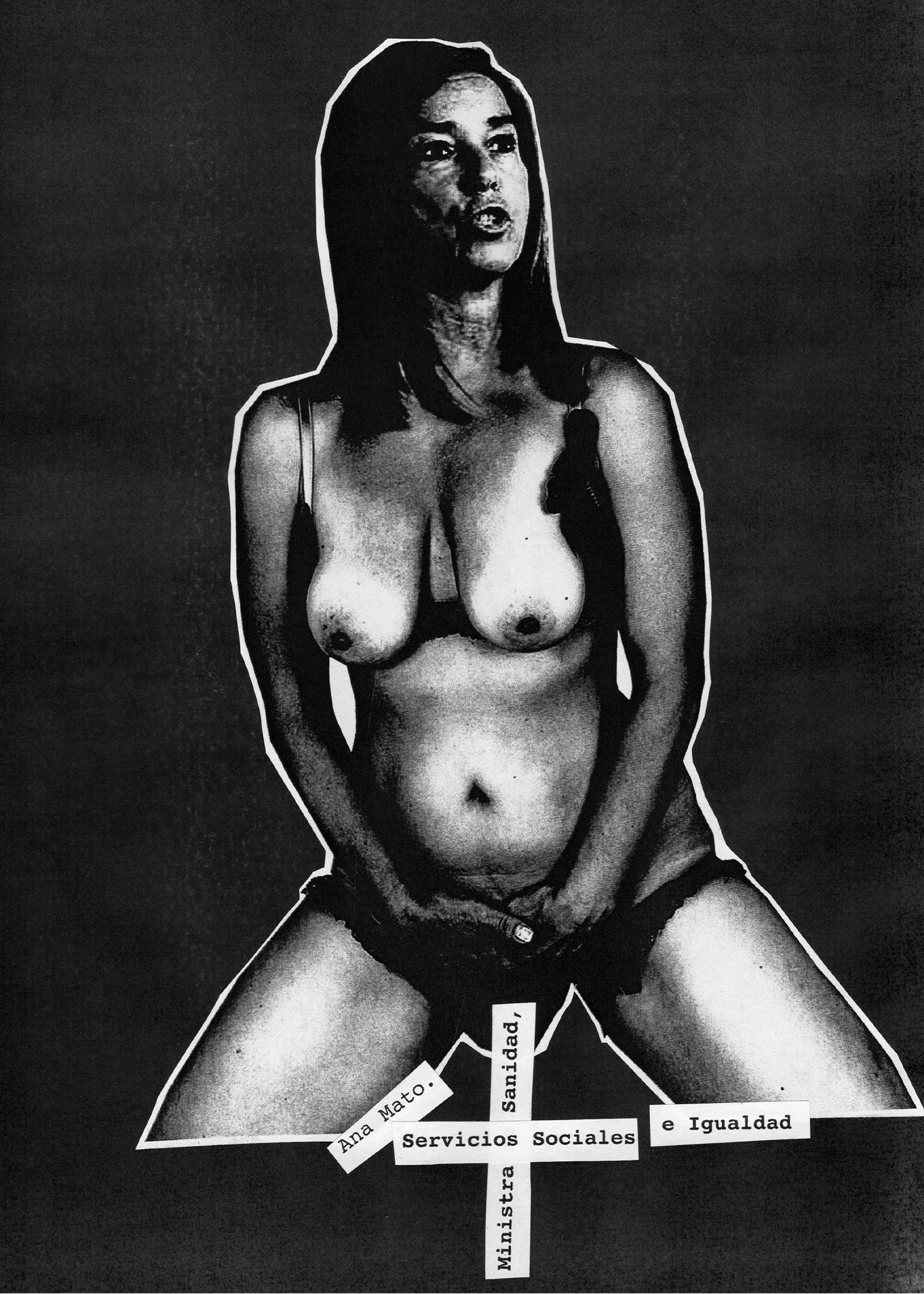

Ana Mato. Minister of Health of the Spanish government.

Luis de Guindos. Minister of Economy of the Spanish government.

María Fátima Báñez. Minister of Employment of the Spanish government.

Alberto Ruiz-Gallardón. Minister of Justice of the Spanish government.

María Dolores de Cospedal. Secretary General of the political party of the government of Spain.

Neoliberal orgasm

(Spanish State 2011-2018), 2013.

In 2008, an economic crisis began in the United States that would become worldwide, its magnitude was only comparable to the Great Depression of 1929.

This great world crisis was caused by the excessive greed of deregulated financial institutions that, when faced with deflation[1] or very cheap money, decided to carry out an aggressive expansion of financial credit by granting excessive loans to people they knew did not have enough economic margin to be able to pay them back when the interest rates rose again. Among these lines of credit were the so-called 'sub-prime mortgages', 'sub-prime mortgages' or 'junk mortgages', which the banks turned into toxic assets[2] that they bought and sold among themselves. These speculative practices spread around the world with banks operating without any control.

In September 2008, one of the main banks in Staudin went bankrupt and the real estate bubble burst. As if they were dominoes, all the financial institutions on a global scale that held a large amount of these toxic assets began to fall. Faced with this situation, banks closed their credit lines, causing the ruin of a multitude of companies and leading to unemployment, poverty and despair for millions of people. In Spain in 2013 an all-time high of unemployment was reached with five million unemployed.

"It is the end of the ideology that free and deregulated markets always work," said Nobel Prize winner Joseph Stiglitz in 2008.

Faced with this situation that threatened to collapse the world economic system, governments, fearful that their national economies would collapse, decided to bail out the banks that held these toxic financial assets. Public money that, in the case of Spain, the banks did not pay back. Only 10% of the billions of euros lent were recovered.

The consequences of the global economic crisis in Spain were particularly devastating as it was an overly indebted economy, highly dependent on the construction sector, a victim of decades of erratic policies of waste and institutionalized corruption since the Franco dictatorship.

In Spain, in order to rescue the bankrupt financial institutions, a bailout had to be requested from the European Union, which, in exchange for its concession, forced the government to make savage cuts in public spending. The application of these economic measures led to the collapse of the welfare state.

These austerity measures in Spanish public spending were initiated by a social democratic government and continued by an ultra-liberal, conservative and authoritarian Christian Democrat government which, taking advantage of the situation and its absolute majority in parliament, took the austerity policies imposed by Europe much further.

As if it were an endless neoliberal orgy, while this ultra-liberal Christian Democrat government announced weekly cuts in public services, its policies verified private entities and deepened even more the deregulation and liberalization of markets that had been the cause of the world crisis.

[1] Sustained decline in the prices of goods and services.

[2] Low quality financial product and high risk, whose book value is higher than the market price.

This text has been automatically translated by the Deepl app. Due to the nuances of automatic translation, there may be slight differences.

This great world crisis was caused by the excessive greed of deregulated financial institutions that, when faced with deflation[1] or very cheap money, decided to carry out an aggressive expansion of financial credit by granting excessive loans to people they knew did not have enough economic margin to be able to pay them back when the interest rates rose again. Among these lines of credit were the so-called 'sub-prime mortgages', 'sub-prime mortgages' or 'junk mortgages', which the banks turned into toxic assets[2] that they bought and sold among themselves. These speculative practices spread around the world with banks operating without any control.

In September 2008, one of the main banks in Staudin went bankrupt and the real estate bubble burst. As if they were dominoes, all the financial institutions on a global scale that held a large amount of these toxic assets began to fall. Faced with this situation, banks closed their credit lines, causing the ruin of a multitude of companies and leading to unemployment, poverty and despair for millions of people. In Spain in 2013 an all-time high of unemployment was reached with five million unemployed.

"It is the end of the ideology that free and deregulated markets always work," said Nobel Prize winner Joseph Stiglitz in 2008.

Faced with this situation that threatened to collapse the world economic system, governments, fearful that their national economies would collapse, decided to bail out the banks that held these toxic financial assets. Public money that, in the case of Spain, the banks did not pay back. Only 10% of the billions of euros lent were recovered.

The consequences of the global economic crisis in Spain were particularly devastating as it was an overly indebted economy, highly dependent on the construction sector, a victim of decades of erratic policies of waste and institutionalized corruption since the Franco dictatorship.

In Spain, in order to rescue the bankrupt financial institutions, a bailout had to be requested from the European Union, which, in exchange for its concession, forced the government to make savage cuts in public spending. The application of these economic measures led to the collapse of the welfare state.

These austerity measures in Spanish public spending were initiated by a social democratic government and continued by an ultra-liberal, conservative and authoritarian Christian Democrat government which, taking advantage of the situation and its absolute majority in parliament, took the austerity policies imposed by Europe much further.

As if it were an endless neoliberal orgy, while this ultra-liberal Christian Democrat government announced weekly cuts in public services, its policies verified private entities and deepened even more the deregulation and liberalization of markets that had been the cause of the world crisis.

[1] Sustained decline in the prices of goods and services.

[2] Low quality financial product and high risk, whose book value is higher than the market price.

This text has been automatically translated by the Deepl app. Due to the nuances of automatic translation, there may be slight differences.